Star economist Isabella Weber: “Companies use inflation as excuse to raise prices”

She is currently one of the most sought-after economists in the world: Isabella Weber is an expert on price trends and inflation – and is considered the “inventor” of the gas price cap. She has been awarded the Kurt Rothschild Prize for her work. We had the pleasure of meeting Isabella Weber for an interview and spoke to her about the consequences of price shocks, companies’ scope for action and the failings of politicians. As well as how we can better manage the next price shocks that are coming.

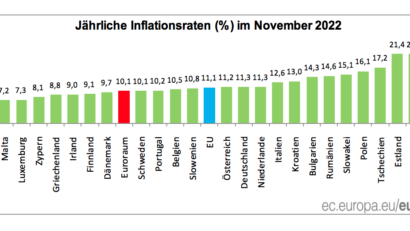

Kontrast.at: Ms. Weber, Austria has been the sad leader in inflation in Western Europe for months. We feel the high prices very strongly when shopping in supermarkets. If you compare the prices of the same products with those in Germany, your jaw drops. Where does that come from? Do the supermarkets in our country inflate prices excessively, or what is the cause?

Isabella Weber: It’s not that companies – such as supermarket chains – have become greedier overnight or anything like that. These price increases are simply part of a capitalist market economy in which companies want to make a profit. And that also means that these companies take every opportunity they can to achieve this goal. In this respect, we are not dealing with a sudden change in mindset or anything similar. Instead, we have experienced external shocks, price shocks, caused by the pandemic and the energy crisis.

1. IT WAS THE PRICE SHOCKS IN SYSTEMICALLY IMPORTANT AREAS THAT FUELED INFLATION IN GENERAL

[embedded content]

Kontrast.at: Now you could say that there were crises in one form or another in previous years as well. Why has inflation now skyrocketed – especially in our country – and remained so high?

Isabella Weber: We experienced high price stability for around 20 years. That was almost exceptional. It was a time that coincided with the financial crisis of 2008/09. There were large economic stimulus packages and a loose monetary policy. Despite this, prices remained relatively stable, and now we suddenly have this high inflation. Why is that? My finding is that there were major price shocks in systemically important areas that had an impact on other areas. So of course the energy sector is very important, but also areas such as raw materials, transportation, etc. At the same time, we have to ask of who is going to pay for these costs or the cost shocks.

In general, the corporate sector in most countries has managed to pass on this cost shock. In short, they have passed on the higher producer and supplier prices. As a rule, profit margins have been kept constant. This means that when energy prices soar – and with them the costs on the business side – and the profit margin remains constant, profits also go up.

Let’s take a refinery as an example: the refinery does the same thing it always does. It processes crude oil into a form so that it can be used. If the price of crude oil goes up, the cost of a ton of oil is still the same. But if the margin remains constant, then profits skyrocket. I would say that is the most general phenomenon.

But of course there were also supply chain bottlenecks that led to a kind of temporary monopoly. All companies in a sector knew, so to speak, that the competition had the same supply problems, and they reacted by raising prices – because they knew that the competition couldn’t undercut them.

2. COMPANIES WERE ABLE TO PASS ON COSTS – IN THE END, EMPLOYEES AND CONSUMERS ARE LEFT TO BEAR THE COST OF INFLATION

Kontrast.at: If companies have been able to protect their profits by and large, who are the losers?

Isabella Weber: If you consider that the corporate sector has protected its margins and at the same time wages have not kept pace with inflation, then the situation is that it is the employees as a whole who are bearing this cost shock. The latter are experiencing a crisis in which they are finding it increasingly difficult to cover the increased cost of living. This is particularly dramatic for the lower income groups.

By and large, the corporate sector has managed to pass on the higher costs and keep profits constant. In the end, consumers pay the price, argues economist Isabella Weber. (Foto: Melissa Mumic)

The German government has opted for measures such as one-off payments, i.e. it has left the price trend itself untouched. A few months ago, the European Central Bank (ECB) took action and raised the key interest rate. How do you assess this measure? What consequences did it have?

Isabella Weber: First, I think you have to realize that the interest rate hikes were a massive intervention. So there is a very massive political intervention in the economy – but through interest rates, not through price regulation. If I raise interest rates at this record speed, as has now been done, then on the one hand this creates a situation where the banks have opportunities to make excess profits. This is because the interest rate increases were not immediately passed on to savers, but were very quickly passed on to borrowers. This has created great profit opportunities. It is said that this is to combat inflation, but in fact such an interest rate hike is aimed at increasing unemployment. This is because higher interest rates affect the economy: investments and purchases become more difficult.

In the end, this also means redundancies. Higher unemployment in turn weakens the position of the employee side in wage negotiations. There is talk, quite euphemistically, of a “cooling off” on the labor market. This is supposed to sound like a spring breeze, but what they really want is for people to lose their jobs so that they have less leeway to demand higher wages. In my opinion, this is an extremely problematic way of doing politics. Because it fuels recessionary tendencies that are already visible in Austria, for example.

The price shocks and interest rate policy have exacerbated inequality in the corporate sector. Because when consumers have to spend all their money on covering basic needs, there is not much left to spend on other things. Companies are noticing this – especially smaller ones that cannot finance themselves on the financial market and are reliant on bank loans. Falling demand is having a massive impact on them.

3. PRICE BRAKES AND EXCESS PROFIT TAXES WOULD (HAVE BEEN) EFFECTIVE MEANS OF COMBATING THE PRICE SHOCK

Kontrast.at: In your opinion, what would have been a better alternative to intervene in the economy in this crisis?

Isabella Weber: I think that it would first have been important to stabilize these central prices or what I also called systemically relevant prices in my research. So that these price shocks don’t rattle through the whole system and have all these knock-on effects. That means, for example: Taxing excess profits. But it can also mean introducing a price cap to cushion the shock and prevent all these second-round effects from being triggered in the first place.

[embedded content]

Of course, in the energy sector in particular, we are talking about prices that hit both companies and households very hard. If it is a situation, as I have tried to explain, in which companies are able to react to these energy price shocks in such a way that their profit volumes increase, then this means that at the same time this energy price shock indirectly exacerbates inflation for households.

In this respect, I think the approach of energy price cap is definitely a good one. Because it protects basic needs. Because part of the energy consumption of households falls into the area of existential needs. I can try to heat less, but there are limits to the potential savings that can be made.

4. “WE NEED A NEW FORM OF STABILIZATION POLICY – ONE THAT AIMS TO SECURE BASIC NEEDS”

Kontrast.at: Do you think that these crises and shocks now have an expiration date? Or will they keep us busy for longer?

Isabella Weber: We are living in very crisis-ridden times. You could say we are living in a time of multiple crises. Climate change is a reality. Extreme weather events are already a reality. The situation in the Middle East is extremely precarious. There is a risk of a regional expansion of the conflict. In this respect, it is very likely that there will be further shocks. It is therefore also necessary to rethink the financial and economic situation. We need to find a different way of reacting to these shocks. We see this with interest rate hikes. They sometimes lead to recession. Then comes the next shock – what then? Interest rate hikes again, more unemployment?

We have to break out of this logic. We need to think about a new type of stabilization policy that aims to protect basic needs against these price shocks.

5. POLITICIANS MUST NOT JUST WATCH AND WAIT FOR THE MARKET – THEY MUST INTERVENE IF IT DOESN’T WORK

Kontrast.at: How does this “breaking out” work? Where should the big change take place?

Isabella Weber: For example, we need a different structure for the energy supply itself – then we won’t be so vulnerable when it comes to price shocks for oil and gas. At the same time, I think we also need ways of reacting to extreme price increases at short notice. For example, by having monitoring processes.

If you look at what has happened to gas prices: Prices have already risen dramatically in the winter of 2021. Sebastian Dullien and I published articles on the topic of gas price caps back in February 2022. Because even then – before the war against Ukraine – it was clear that these gas prices alone could trigger 2.5% inflation. But politicians didn’t say “gas is a systemically relevant price, we have to monitor it and react with measures”. They simply waited. In the case of Germany, until the fall. In the end, people’s basic needs were not protected. There really needs to be a rethink.

[embedded content]

Of course, you can’t always predict everything in advance, but there are prices that you know will have serious consequences if they skyrocket – and you have to react immediately. In this respect, you need a mandate to act.

What we are seeing now is that people are continuing to do their jobs and work – and yet are afraid that they will no longer be able to afford their basic needs. That’s breaking a social contract. The foundation on which a market economy is built is being shaken.

6. THIS INFLATION IS NOT ONLY SHAKING THE ENTIRE ECONOMY, BUT ALSO DEMOCRACY

Kontrast.at: What other dangers do these existential fears pose?

Isabella Weber: Well, if I can no longer be sure that I can meet my basic needs, if I have existential fears, then I become sensitive to angry and sometimes extreme ideas. We can see that in many European countries, radical right-wing or extreme right-wing parties are experiencing an upswing that should give us pause for thought. In the end, democracy is also being shaken.

That is why we need an alternative. The alternative means intervening and rethinking the state and the economy in such a way that they are attractive to the many and secure basic needs.

Who is Isabella Weber?

Isabella Weber is Professor of Economics at the University of Massachusetts, Amherst. Together with Sebastian Dullien (Scientific Director of the Institute for Macroeconomics and Business Cycle Research (IMK) at the Hans Böckler Foundation), she was awarded the Kurt Rothschild Prize this year for her research on the gas price cap to combat inflation.

This work is licensed under the Creative Common License. It can be republished for free, either translated or in the original language. In both cases, please cite Kontrast.at / Kathrin Glösel as the original source/author and set a link to this article on Scoop.me. https://scoop.me/isabella-weber-inflation/

The rights to the content remain with the original publisher. Läs mer…